5 tools to shorten billing and debt collection time - Xtends

Last updated: 13 Nov 2024 | 302 Views |

5 tools to shorten billing and debt collection time

One key challenge in managing accounts receivable is the difficulty of billing and debt collection. The billing process often involves a lengthy verification period and complex document management, which makes managing accounts receivable more difficult. This process becomes more accessible with an efficient system to store data and customer behavior that can be analyzed and linked to assist with billing and debt collection.

Here are five tools that can help reduce the time spent on billing and debt collection, making the accounts receivable process faster and more efficient.

1. Invoicing Software

https://www.invoicera.com/blog/invoicing/10-features-of-invoicing-software/

Invoicing software is a tool that helps organizations or businesses manage and automatically generate invoices for customers, focusing on making the billing and payment process faster, more accurate, and more systematic. This software helps reduce complex steps and minimize errors that may occur in the process. The main features of invoicing software include:

- Automated Invoice Generation

It allows businesses to create and send invoices to customers automatically, including customizing the invoice format as needed. - Payment Status Tracking

It helps track the status of invoices, such as unpaid invoices, overdue invoices, or paid invoices. - Customer Data Management

It records customer information such as contact details, purchase history, and data related to billing. - Tax and Discount Calculation

It calculates taxes, such as VAT, and any discounts that may apply to the invoice, ensuring the information is accurate and complete. - Integration with Accounting Systems

It links invoicing data with the organization's accounting system to ensure financial management is organized and consistent. - Reporting and Data Analysis

It provides reports on payments, outstanding invoices, and analysis of the effectiveness of the collection process.

2. Automated Accounts Receivable

https://www.growfin.ai/blog/why-automate-accounts-receivable-process

https://www.growfin.ai/blog/why-automate-accounts-receivable-process

Automated Accounts Receivable is a software system used for managing and tracking the payment status of customer debts in a business or organization, making the debt collection process more efficient and accurate. It reduces reliance on manual labor in the collection process. The main features of an automated accounts receivable system include:

- Automated Notifications

The system can be configured to send reminders to customers via email, SMS, or automated calls before and after the payment due date, ensuring they are informed about the payment status and due dates. - Systematic Debt Tracking

The system continuously tracks debt status, displaying information such as paid, partially paid, overdue, and unpaid debts, allowing accounting teams to plan debt collection more effectively. - Payment Tracking and Management

This system can integrate with various payment methods, such as credit cards, banks, or electronic money transfers, enabling real-time recording and tracking of customer payments. - Analysis and Reporting

The system can generate reports on debt tracking and payments, making it easier to analyze, such as an overview of outstanding accounts, cash flow projections, and risk assessment of debt collection. - Customizable Tracking Settings

The system allows customization of debt tracking settings, such as setting reminder schedules, contact channels, and the level of rigor in following up and aligning with business policies.

3. Credit Analysis Tools

https://www.freepik.com/free-photos-vectors/credit-management

Credit Analysis Tools are software or systems that help organizations assess the creditworthiness and ability of customers to repay debts. These tools gather and analyze financial data, payment history, and other relevant factors to evaluate customer reliability and risk accurately. They assist in making decisions regarding credit granting or payment terms. The main features of credit analysis tools include:

- Data Collection and Credit Verification

These tools help pull credit data from various sources, such as credit bureaus or internal databases, to check payment history, financial status, and past business dealings with customers. - Credit Scoring

Credit analysis tools often include a credit scoring function, which evaluates risk factors such as payment history, income, debt obligations, and credit utilization. This helps organizations assess the risk of extending credit to a customer. - Risk Analysis

The tool identifies the customer's risk level through multi-dimensional analysis, such as frequency of missed payments, bankruptcy history, and debt-to-income ratio, providing the organization with precise data to decide on credit approval or order processing. - Reporting and Monitoring

The tools generate credit status reports for individual customers and groups, allowing credit managers to monitor the analysis results and have an overview of credit activity across customer segments. - Automated Credit Approval Conditions

Some tools can automatically approve credit for customers with high credit scores and low risk or require additional checks for customers with higher risks based on precise conditions and procedures.

4. Financial Dashboards & Reporting

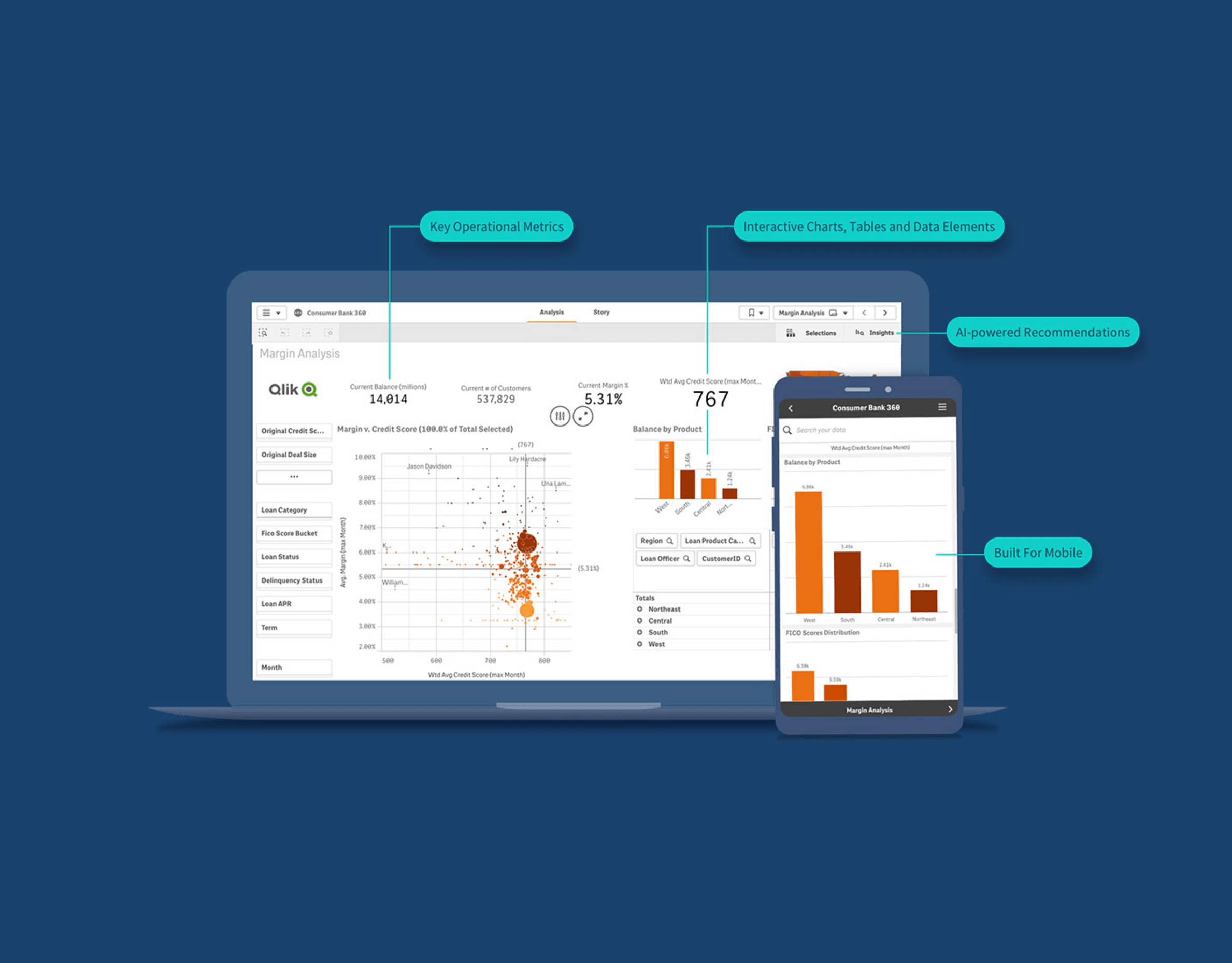

Financial Dashboards & Reporting for Invoice Management and Debt Collection is a tool that helps businesses efficiently track invoice data and the payment status of customers. It presents vital information in an easy-to-understand format through dashboards and reports, allowing finance and accounting teams to manage the invoicing and debt collection process in an organized manner, reducing the complexity of various steps. The main features of financial dashboards and reporting include:

- Financial Data Visualization

Financial dashboards present vital data such as revenue, expenses, gross profit, cash flow, and financial ratios through graphs, charts, and easy-to-understand indicators, helping users quickly assess a business's economic status. - Tracking Key Performance Indicators (KPIs)

This tool helps businesses monitor important financial KPIs such as EBITDA, debt-to-asset ratio, ROA, and net profit margin, which are crucial for strategic decision-making. - In-depth Financial Analysis

The dashboard provides insights such as trends in revenue and expenses, expense ratios, revenue distribution by product or department, and business growth, offering a clearer understanding of the organization's financial structure and direction. - Automated Report Generation and Customization

The reporting tool enables finance teams to create automated reports based on specific needs, allowing customization of formats, content, and report scheduling, such as monthly or quarterly reports. - Scenario Analysis & Forecasting

Some dashboards offer financial forecasting models, such as cash flow projections, profit and loss analysis, and scenario analysis, which help organizations plan their future financial strategies more effectively.

5. Document Management Systems (DMS)

Document Management System (DMS) is a system that helps efficiently store, manage, and search documents related to the invoicing and debt collection process. It is instrumental in managing invoices, payment information, and documents associated with debt collection. It makes these processes more organized, reduces paper usage, and enhances the convenience of document search and sharing. Critical features of DMS to assist with invoicing and debt collection management include:

- Digital Document Storage and Organization

DMS helps store documents such as invoices, payment agreements, and debt collection records in digital format, reducing the hassle of paper document storage and effectively saving space. - Quick Document Search

The DMS system allows for the categorization and immediate search of required documents, such as finding invoices by number, date, or customer name, enabling the accounting department to access essential documents quickly and reducing the time spent searching. - Access Control

The system allows for setting access permissions, specifying who can view or edit documents related to payments or accounts receivable. This enhances security and prevents unauthorized access to sensitive information. - Audit Trail

The system logs information on who accessed or modified documents and when providing transparency and accountability in the process. - Automated Document Creation and Distribution

DMS can be configured to generate invoices automatically, send documents to customers, and send payment reminders on due dates, reducing time spent on repetitive tasks and improving operational efficiency.

These tools not only help make invoice creation quick and accurate but also enable the accounting department to instantly track customers' payment status. This greatly enhances accounts receivable management, significantly reducing time and errors in operations.